ITC Case Study: How a Tobacco Pioneer Became an FMCG Giant

This ITC case study tells the story of how a big company started and grew, offering lessons for student entrepreneurs in India. ITC began as a British tobacco firm and became a diversified group. Today it is a leading FMCG and hospitality company. The case highlights entrepreneurship lessons and business strategy in easy terms

1. Inception

ITC began in 1910 in Kolkata (then Calcutta) as the Imperial Tobacco Company of India Limited. It was set up by British partners to sell cigarettes in India. The first cigarette factory was built in Bangalore in 1913. Early on, ITC made cigarettes and tobacco products. It worked with local farmers (for example in Andhra Pradesh) to get good tobacco leaves. The founders aimed to meet India’s tobacco demand under British rule.

At the start, ITC had British managers and local employees. It was funded by its parent company in England, so it did not need outside investors. The company kept costs low by sourcing and making key inputs (like tobacco leaves and paper) in India. Its products quickly became popular among smokers, and it faced little competition at first. The tobacco market grew under colonial trade rules, so ITC soon led the market. The success of its cigarettes gave ITC money to expand. In 1970 the firm Indianized its name to India Tobacco Company, and in 1974 it became I.T.C. Limited to mark its entry into new businesses.

2. Present Scenario

Today ITC is a massive company with a strong financial position. It is the second-largest FMCG company in India and a top tobacco firm globally. In FY2024 it reported ₹69,446 crore revenue and ₹20,422 crore net profit. This profit figure was about 8.9% higher than the previous year. ITC’s market capitalization is around ₹5.4 lakh crore. making it one of India’s most valuable firms. Its stock has risen about 187% over the past five years. Many investors see ITC as a stable performer. The company employs about 36,500 people and sells products in 6 million retail outlets across India, giving it a huge scale and reach.

In the industry, ITC leads in cigarettes (about 80% share of organized market). In consumer goods, it competes with firms like Hindustan Unilever and Nestlé but has strong brands in flour (Aashirvaad), biscuits (Sunfeast), noodles (Yippee), and personal care (Savlon, Fiama). In hospitality, ITC Hotels is a top Indian hotel chain (competing with Taj and others). The paperboards and packaging segment is highly competitive, yet ITC holds about 26% share of Indian paperboards.

Recent developments include the demerger of ITC's hotel business into a separate company (effective Jan 2025) In 2025 ITC announced plans to buy Century Pulp & Paper (from Aditya Birla) to grow its paper division. The company has also been forming partnerships in new areas, like taking a stake in a baby-care startup. Overall, ITC’s financial health is good it has rising sales and healthy profit margins (net margin nearly 29%). Its large cash reserves allow it to invest in growth. The current situation is strong, but the company also faces competition from other big FMCG and hospitality firms.

3. Future Outlook

Looking ahead, ITC's future depends on India’s growing market and global trends. The FMCG sector in India is expected to grow as incomes rise. ITC has opportunities to expand in foods (like ready-to-eat and health foods), personal care, and premium products. Its strong R&D center (with 800+ patent applications). means it can keep innovating. The recent acquisition of Century Pulp & Paper suggests ITC will grow in packaging and paper, which are needed for e-commerce and FMCG packaging. In agriculture, India needs food security, so ITC's work in farm tech (like its climate-smart farming program) could pay off. Global trends like eco-friendly packaging (e.g. ITC's new moulded fibre plant and health products (e.g. juices, natural personal care) are areas ITC can focus on.

However, ITC must also adapt to challenges. People are smoking less worldwide, so ITC has to shift more into non-tobacco goods. The company’s history of diversification (from tobacco to many businesses is a strength here. If the economy slows or if there are strict laws or taxes on tobacco, ITC's growth could slow. On the bright side, India's large young population will continue to buy packaged foods, personal care, and travel (helping hotels). With wise investment in innovation and markets, ITC is likely to remain a major player.

4. Opportunities for Young Entrepreneurs

- FMCG (Food & Daily Goods): India’s FMCG market is big and growing. Entrepreneurs can launch brands of healthy snacks, natural soaps, or ready-to-cook foods. For example, ITC grew Aashirvaad and Sunfeast by focusing on quality. A new startup could do the same with a local or organic twist.

- Agritech & Digital Farming: Young founders can create apps or online markets for farmers. ITC’s e-Choupal program showed how an internet kiosk run by a local farmer can give price quotes and weather info to nearby farms. A student could build a village portal or delivery service that helps farmers sell directly to consumers or food companies.

- Eco-friendly Packaging & Paper: ITC is also a leader in paper and packaging. There’s room for startups that make recycled paper products, biodegradable packaging, or smart labels. For example, Entrepreneurs could design plant-based food wrappers or custom cardboard boxes for online sellers.

- Wellness & Health Products: More Indians want healthy and natural products. ITC even launched new whole-grain and herbal foods for people over 45. Entrepreneurs ideas here include herbal teas, nutrient bars, or yoga/fitness classes. Finding a special health niche (like organic dog food or elder-friendly meals) can be a winning strategy

- Learn from e-Choupal (Digital Farm Tech): e-Choupal is ITC’s flagship digital solution for farmers. It shows how tech can solve farm problems. Entrepreneurs can study this model or partner with local e-Choupal kiosks to pilot their own apps or services for farmers.

- Attend ITC Training Programs: ITC trains farmers in new methods (like climate-smart farming) to boost yields. Entrepreneurs can join these programs, internships, or agricultural skill centers run by ITC and partners to learn farming, supply-chain, or rural marketing. This hands-on learning is very valuable.

- Use ITC’s Distribution Network: ITC reaches millions of shops and runs an online store. In 2024, ITC’s sales network covered nearly 7 million retail outlets and it launched an ‘ITC e-Store’ with 800+ products. Startups can try to sell their products through these channels or collaborate with ITC’s rural stockists (for example, by supplying spice blends, grains, or handicrafts to ITC’s retail network).

- Mentors and Experts: ITC has many business experts. Young founders can look for mentorship through industry events or CII/ITC sustainable development programs. Even connecting with ITC alumni (e.g. from ITC’s CSR centre or trade academy) can give guidance on manufacturing and branding.

5. Market Share

ITC holds leading shares in several markets. For example, it controls about 80% of India’s organized cigarette market In packaged wheat flour, ITC's Aashirvaad brand has roughly 52% market share. In stationery, Classmate notebooks are the market leader with about 20% share. In paperboards, ITC has about 26% value share of the Indian market. The table below summarizes some key market shares:

| Sector/Brand | ITC’s Share (approx.) |

|---|---|

| Cigarettes (organised market) | 80% |

| Packaged wheat flour (Aashirvaad) | 52% |

| Stationery notebooks (Classmate) | 20% |

| Paperboards and packaging (value) | 26% |

These strong positions show how dominant ITC is in its core areas. Even in sectors where it competes more, ITC’s brands rank at or near the top.

6. Critical Metrics

Important numbers for ITC include revenue, profit, and other financials. In FY2023–24:

- Revenue: ₹69,446 crore.

- Net Profit: ₹20,422 crore (about 29% net margin).

- Market Cap: ~₹5,45,000 crore (mid-2025).

- Employees: 36,500.

- Retail Reach: 6 million outlets.

- P/E Ratio: ~27 (stock price ₹435, P/E 27.4).

- Dividend Yield: ~3.1% (consistent payments).

These metrics show ITC’s scale and profitability. Its high return on equity (~28%) and low debt are also positive signs. The vast distribution (millions of outlets) is a key strength for reaching customers.

7. New Opportunities on the Horizon

ITC is exploring several growth areas. One big step is the Century Pulp & Paper acquisition (₹3,498 crore deal). This will add capacity and an important plant in north India, helping ITC’s paper and packaging business grow. In agribusiness, ITC has built new facilities (for example, a nicotine extraction plant) to export value-added products. It is also expanding in health and wellness products (like juices, baby care via partnerships) and sustainable packaging (e.g. a new moulded fibre plant). The company's strong R&D lab (with hundreds of patents) means more innovations are coming. ITC is also using digital tools (e-choupal network, data analytics) to boost farming yields and sales. Overall, ITC's investments in acquisitions, new products, and green initiatives point to future growth areas.

8. Risks and Challenges Ahead

Despite its strengths, ITC faces challenges. Its tobacco business is subject to heavy taxes and strict regulations. Recently, higher leaf-tobacco costs and tax hikes were pressures that ITC had to manage carefully. New health laws or plain-packaging rules could hurt future cigarette profits. In agribusiness, government export restrictions (e.g. on wheat or pulses for food security) have cut opportunities. The company’s paper segment faces low demand and competition from low-priced imports, which can squeeze margins.

Internally, ITC must continue shifting its focus from tobacco to consumer goods, which can be difficult for an old company culture. Economic slowdowns or rising costs (raw materials, fuel) could also hit sales. Finally, ITC’s hotel business must recover from travel disruptions. In short, ITC must navigate industry regulations, economic ups and downs, and intense competition to keep growing. The company’s history of strong management and agility will be tested by these challenges

9. Company’s MOAT

ITC’s competitive moat comes from its unique strengths. Its iconic brands and distribution give it pricing power. For example, ITC’s cigarette brands dominate the market, letting ITC earn high profit margins. The company’s integrated model (owning everything from leaf farms to packaging) cuts costs and increases control. With 6 million retail outlets and a nationwide network, ITC can sell products everywhere. Its diversified portfolio means it is not tied to one industry.

ITC also invests heavily in innovation. Its in-house R&D lab and science teams (800+ patents), keep ITC ahead in product development. The company’s focus on sustainability (over 50% energy from renewables in paper mills) and quality has built trust. All these create barriers for competitors. Overall, ITC’s strong brands, vast supply chain, R&D focus, and scale form a tough-to-copy advantage

10. Revenue Model

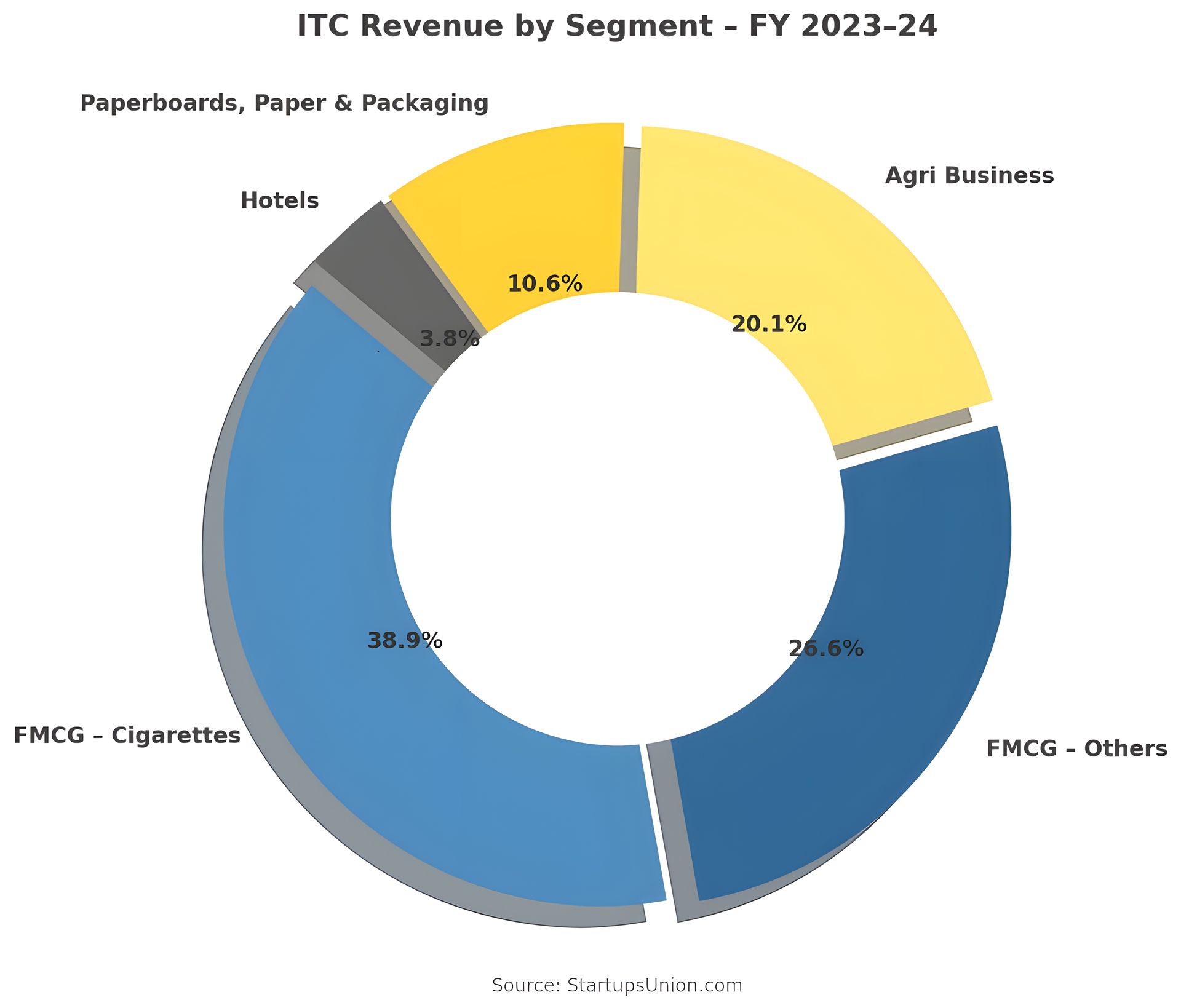

ITC

earns money by selling products and services in each business area. The largest chunk is

cigarettes and tobacco products – brands like Gold Flake, Classic, and Wills Navy Cut. These account for the biggest share of profit.

The rest of FMCG (Fast-Moving Consumer Goods) includes branded foods (Aashirvaad atta, Yippee noodles, Sunfeast biscuits, Bingo! snacks), personal care items (Savlon handwash, Fiama soap), stationery (Classmate notebooks) and lifestyle products. These are sold through ITC’s distribution network. The agri business makes money by buying and selling farm commodities (tobacco leaf, spices, soya) and helping farmers with technology. The paperboards and packaging segment sells cardboard, packaging, and printing paper to companies (including ITC’s own packaging needs). The hotels segment earns revenue from room bookings, banquets, restaurants and tourism services at ITC Hotels properties.

In summary, ITC’s revenue model is:

- Cigarettes: Selling branded cigarettes and tobacco.

- FMCG Foods & Products: Selling packaged foods, personal care, stationery brands.

- Agribusiness: Trading farm products and related inputs.

- Paper & Packaging: Selling paperboards and packaging solutions.

- Hotels: Earning fees from hotel and resort services.

| Business Segment | FY2023–24 Revenue (₹ Crores) | Notes |

|---|---|---|

| FMCG – Cigarettes | 27,014.57 | Largest segment (~38.9% of gross sales) |

| FMCG – Others (Foods, Personal Care, etc.) | 18,472.68 | ~26.6% of gross sales |

| Agri Business | 13,958.68 | ↓20.1% YoY (impacted by commodity trade restrictions) |

| Paperboards, Paper & Packaging | 7361.29 | ~10.6% of gross sales |

| Hotels (Standalone) | 2,638.95 | ↑3.8% YoY; record revenue and profits |

| Total (Gross) | 69,446.20 | Gross sales from products & services |

Table: Segment-wise revenue (gross) for FY2023–24.

| Metric | FY2023–24 | FY2022–23 | YoY Change |

|---|---|---|---|

| Total Revenue | ₹69,446.20 Cr | ₹69,480.89 Cr (FY22–23) | ~0% (flat) |

| EBITDA | ₹24,478.61 Cr | (↑26.5% YoY in FY22–23) | — |

| Profit Before Tax (PBT) | ₹26,323.34 Cr | (FY23: +24.4% YoY) | +6.7% YoY |

| Profit After Tax (PAT) | ₹20,421.97 Cr | ₹18,753.31 Cr | +8.9% YoY |

| EPS (Basic) | ₹16.39 | ₹15.15 | – |

Table: Key financial metrics for FY2023–24 (standalone). EBITDA, PBT and PAT figures reflect strong margins despite flat revenues.

Leanings-

Student and new entrepreneurs can learn many lessons from ITC’s story.

1. Diversify and innovate: ITC shows the value of not relying on one product. It moved beyond cigarettes into food, hotels, and more. This reduced risk when smoking faces health rules. Small entrepreneurs should also plan for new products and markets.

2. Know your customer: ITC studied Indian tastes well. For example, it launched Aashirvaad Atta (flour) with the promise of "chakki fresh" wheat, matching local preferences. Startups should deeply understand what their customers want.

3. Leverage strengths: ITC used its strong distribution and brand to launch new items. Entrepreneurs can use their own networks and skills in new ways.

4. Invest in quality and R&D: ITC’s research lab and quality control help it stay ahead. Likewise, student founders should focus on making reliable, well-designed products.

5. Build brand trust: Over time, ITC brands like Sunfeast and Savlon earned consumer trust. New entrepreneurs can learn to be patient and ethical in building a brand. In short, ITC’s journey teaches the importance of vision, adaptation, and customer focus.

Sources: Official company reports and trusted news article, provide the facts above.

Business Model of ITC